Manufacturing insurance

Manufacturers insurance designed to fit your business

Our customizable manufacturing insurance policies provide coverage options and risk controls that help protect your business. The service you receive from Sentry is backed by more than 120 years of experience—and our Midwestern values inform everything we do.

Let's talk

We offer local service and customized coverage. Let us put our industry knowledge to work for you.

Manufacturing insurance with a personal touch

Our experienced agents are ready to learn about you—and the unique risks your manufacturing business faces. They’ll work with you to develop an insurance policy for your manufacturing business that helps protect your company and your employees.

We believe our business is to get to know your business. That’s exactly what we do.

Manufacturing insurance for small businesses and large companies

Whether you’re a small local business with a few employees, or a large company with locations nationwide, we offer business insurance solutions, experienced staff, and knowledgeable claims services.

Who needs manufacturing insurance?

At Sentry, we offer specialized manufacturing business protection for:

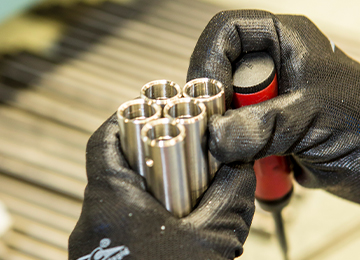

Metalworking

Electronic components

Food processing

Plastics and rubber goods

Farm equipment

Printing

What does a manufacturing insurance policy cover?

Our manufacturers coverage options are designed to meet your unique needs—helping minimize risk to your operations, employees, products, and equipment when the unexpected happens.

Here are a few options we offer:

General liability: Our general liability insurance helps protect your large or small business from losses caused by your services, operations, or employees.

Workers’ compensation: From large or small deductible plans to self-insured workers’ compensation, we have a variety of policy options that can help you when an employee gets sick or injured on the job.

Business income insurance: If you’re forced to temporarily close your business after a property loss, this kind of coverage can help you cover things like payroll and operating expenses while business is interrupted.

Equipment breakdown coverage: We offer protection against breakdowns for mechanical equipment like engines, fans, and conveyers. We can also help protect electrical equipment like computers, generators, and motors, along with traditional boilers and machinery.

Cyber liability: Losing sensitive data can be just as devastating as physical property loss. Our cyber liability insurance will help cover you if confidential data is compromised at your company.

How much does manufacturing insurance cost?

Manufacturing insurance costs depend on a variety of risk factors. Every business is unique, so insurance costs are unique. Want more information on our custom policies?

Protecting your manufacturing property—before and after loss

We’re here to help you when something happens, but we also want to help you reduce your overall risk exposure—for the good of your business and the safety of your employees.

We offer safety resources that can teach you how to identify hazards at your business—helping you control losses and avoid claims. Our specialized safety services include:

Loss trend analysis

On-site safety and hazard assessments

Workplace safety program development

Best practice reviews and product liabilities

Safety committee development

Training resources

Manufacturing businesses we serve

Electronic component manufacturing insurance

We know how important your electronic manufacturing business and your employees are to you. Let us help protect them.

Food processing insurance

When it comes to food processing insurance, there's no substitute for peace of mind. We'll help you protect what matters most to you.

Metalworking insurance

We'll insure your metalworking business—with industry-specific coverage plans, safety guides, and an experienced team—and help you protect what you work for.

Farm equipment manufacturing insurance

We're exclusively endorsed by the Farm Equipment Manufacturers Association and trusted throughout the farm equipment manufacturing industry.

Plastics and rubber goods insurance

With specialized insurance plans and an experienced team, we'll help you protect your plastics/rubber goods business and the employees who make it successful.

Printers insurance

We know your printing business has unique risk exposures. We'll provide safety analysis, specialized coverage plans, and 24/7 account access.

FAQs

Yes. Some types of coverage, such as workers’ compensation, may be required. Insurance is a vital part of protecting your business and your employees. You can find an agent to talk about what types of coverages may be right for you.

One common type of coverage is product liability insurance, which helps protect your business if someone is injured or something is damaged by one of your products. You can also get premises liability insurance, general liability insurance, business liability insurance, or cyber liability insurance.

Manufacturing insurance includes several different types of coverage, including business income insurance, workers’ compensation insurance, and equipment breakdown insurance, and more.

Our customer success stories

See other storiesRelated resources

Manufacturing resources

Explore our resources, featuring valuable tools, articles, and guides on topics related to insurance coverages, safety resources, and retirement strategies.

2024 Manufacturing Injury Report

Discover the latest trends, risks, and costs involving workplace injuries in the manufacturing industry.