SECURE 2.0 overview

A brief summary for 401(k) plan sponsors and participants

The SECURE 2.0 Act has already made significant changes to the way U.S. retirement plans operate—and more are on the horizon.

Passed in 2022, SECURE 2.0 expands on the SECURE Act of 2019, also known as the Setting Every Community Up for Retirement Enhancement Act. SECURE 2.0 includes more than 90 provisions that aim to help people reach their retirement goals by expanding enrollment and offering incentives to save.

These changes have significant implications for plan sponsors and participants—but you don’t have to navigate them on your own. We’re here to help guide you through the important steps.

Not a Sentry customer? See what we have to offer for retirement planning.

Download our SECURE 2.0 informational sheet for an overview of upcoming changes and contact information for Sentry representatives.

What do I need to know about upcoming changes?

If you’re a plan sponsor, you'll need to be aware of upcoming changes and how you may need to implement them at your business. Here are two of the biggest provisions to be aware of:

Roth catch-up contribution changes

Your 401(k) plan likely already allows for catch-up contributions, which are additional 401(k) contributions made by employees who are at least 50 years old and have exceeded the $23,500 contributions limit for 2025.

Catch-up eligible employees can contribute an additional amount, which is based on their age:

Ages 50–59: $7,500

Ages 60–63: $11,250

Ages 64 and above: $7,500

Contribution limits are subject to change every year.

Under SECURE 2.0, any employee who earned more than $145,000 (amount subject to change on a yearly basis) in FICA wages from the prior calendar year must make catch-up contributions on a Roth basis starting January 2026.

Catch-up eligible employees who earned $145,000 or less in the prior year can continue to make catch-up contributions on a pre-tax or Roth basis.

Originally effective in January 2024, this provision was delayed until January 2026 by IRS Notice 2023-62. This two-year administrative transition period gives plan sponsors and their payroll vendors more time to prepare for this provision.

Self-certification of hardship

Under SECURE 2.0, employers have the option of allowing employees to self-certify their own hardship.

This means a participant who takes an early distribution from their 401(k) account to help pay for an immediate financial need can do so without the extra step of the employer reviewing and approving the hardship reason and amount. Hardships can include expenses for healthcare, housing or home repairs, tuition, and funerals.

However, participants still shouldn't take early withdrawals lightly, because they come with penalties, like additional taxes.

When can I expect these changes?

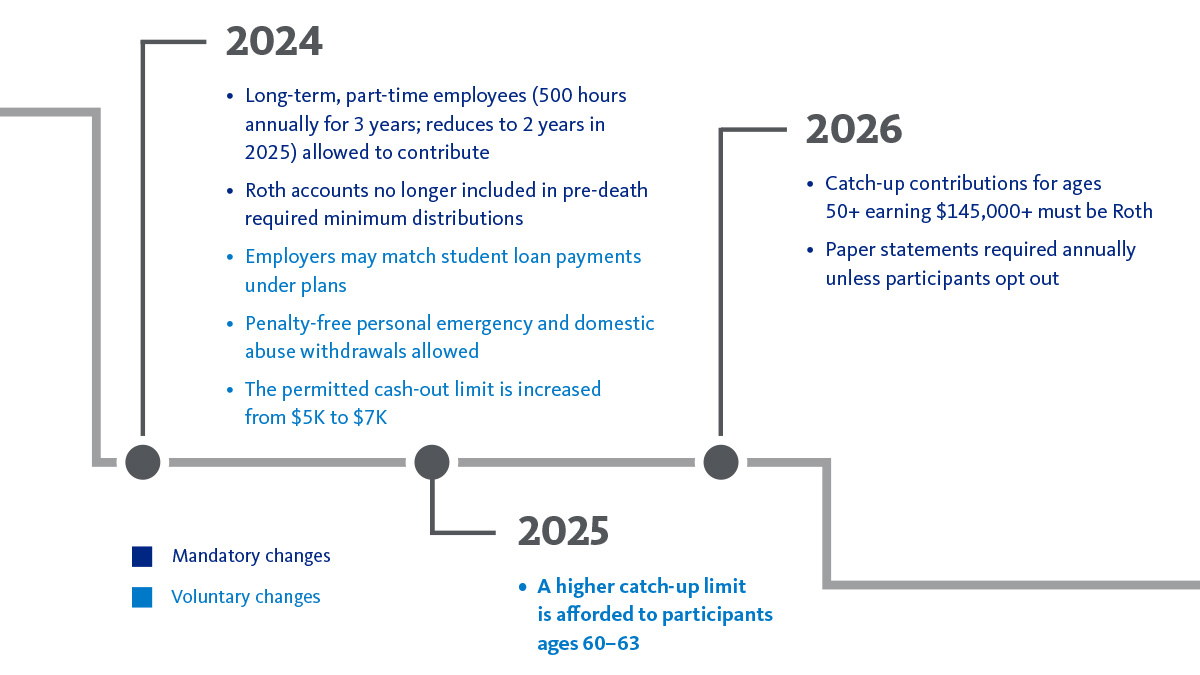

Please note that some changes included in the SECURE Act of 2019 have been or will be changed again under SECURE 2.0. View this timeline to see significant voluntary changes.

Frequently asked questions

Below, you’ll find answers to common SECURE 2.0 questions. For more, view the full list of questions.

This act includes a combination of mandatory and voluntary changes focused on expanding coverage, increasing employee savings, and allowing additional options for participants to access their savings.

Some provisions went into effect in 2022, while others will continue to go into effect through 2033.

In many cases, further guidance from the IRS and U.S. Department of Labor (DOL) is required to fully understand and implement many of SECURE 2.0’s provisions.

Contact your Client Services Manager with any questions.

Sentry doesn’t charge for amendments. However, many of the provisions may increase your plan’s administrative costs in ways that aren’t currently clear. Additionally, fees may be assessed by your payroll provider or other service providers.

Sentry provides ongoing support, including participant enrollment materials, email communications, notice preparation, and employee education.

We’ll notify you as additional guidance on SECURE 2.0 from the IRS and DOL becomes available.

The original SECURE Act requires employers to allow LTPT employees to make 401(k) contributions under your plan. The act defines an LTPT employee as someone who worked 500 hours or more in each of the three consecutive 12-month periods prior to 2024 and meets the plan age requirement.

The SECURE 2.0 Act redefined LTPT as an employee who worked 500 hours or more in each of the two consecutive 12-month periods—effective starting in 2025.

Under SECURE 2.0, higher-income employees must make catch-up contributions on a Roth basis. Employees who made $145,000 or less in the previous year can continue to make contributions on a pre-tax or Roth basis.

This provision was originally set to take effect in 2024. However, the IRS announced on August 25, 2023, that the effective date would be pushed back to 2026. The two-year administrative transition period will allow the time necessary for plan sponsors and their payroll vendors to comply with this new rule.

What if I have more questions?

If you have a question about SECURE 2.0 or Sentry’s other 401(k) services, send us an email.