Plan ahead with your Sentry retirement account

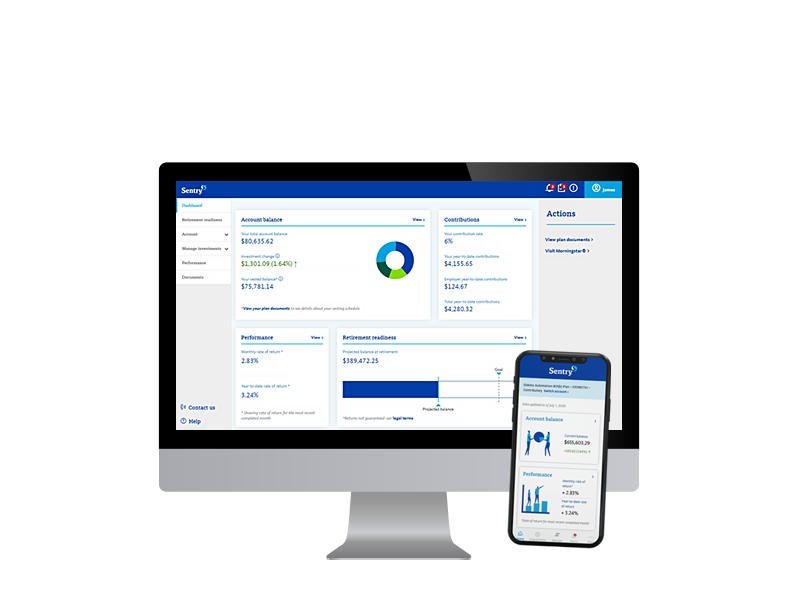

Manage your account online

Track your savings, make investment changes, and manage personal details anytime.

Download the Sentry Retirement app

Access your account anytime, anywhere from our secure mobile app. It’s available on the Apple App Store and Google Play.

Plan for your future with financial calculators

You have a lot to consider when planning for retirement. That’s why we offer a suite of calculators to help you make financial decisions.

Frequently asked questions

We’ll need your birth date, Social Security number, and personal email address to find your account information. Here’s some other information to consider:

We’ll ask you for beneficiary information, including birth dates and Social Security numbers. Note: Adding beneficiaries isn’t required during enrollment.

If you have existing retirement money you’d like to roll in to your Sentry retirement account, have the existing account name and estimated amount ready, and contact the prior carrier to acquire the proper paperwork to complete the rollover.

We take your security seriously. That’s why we take steps to verify your identity before you can access your account. While this is typically an easy process, there are a few instances where you may have trouble validating your identity. In this case, contact your employer. They’ll work with us to resolve any issues.

Your username is the email address that was used to sign up for your account. We recommend you don’t use your work email—in the event you leave your employer, you wouldn’t be able to access your account.

Vesting is a right to earn employer-provided benefits over time. If your employer offers an employer-funded match to your 401(k) and it has a vesting schedule, that means you need to work for a certain amount of time to earn the amount they contribute to your retirement fund. Vesting schedules can vary.

To request a distribution/withdrawal:

Log in to your account

Choose Manage investments then Distributions from the menu

On the distributions page, select Request a new distribution

Follow the prompts

Your money stays in your account if you leave your employer and your account balance is greater than $7,000. Your plan may have a lower cash limit which may remain the same. You can choose to move your money (also known as a rollover) to another qualifying retirement account, such as a new employer 401(k) or IRA. You can request a rollover by logging in to your online account. See How do I request a distribution? above for more information.

Related resources

Understanding your investment options

Interested in learning more about investing? Our glossary of terms is a good place to start.

Can you afford the cost of waiting?

The sooner you begin saving for retirement, the more money you'll be able to accumulate in savings.

Questions?

If you have questions about completed transactions or any concerns about your online account, contact us.